Quick-Commerce Sync: How to Coordinate Influencer Drops with Blinkit and Zepto Inventory

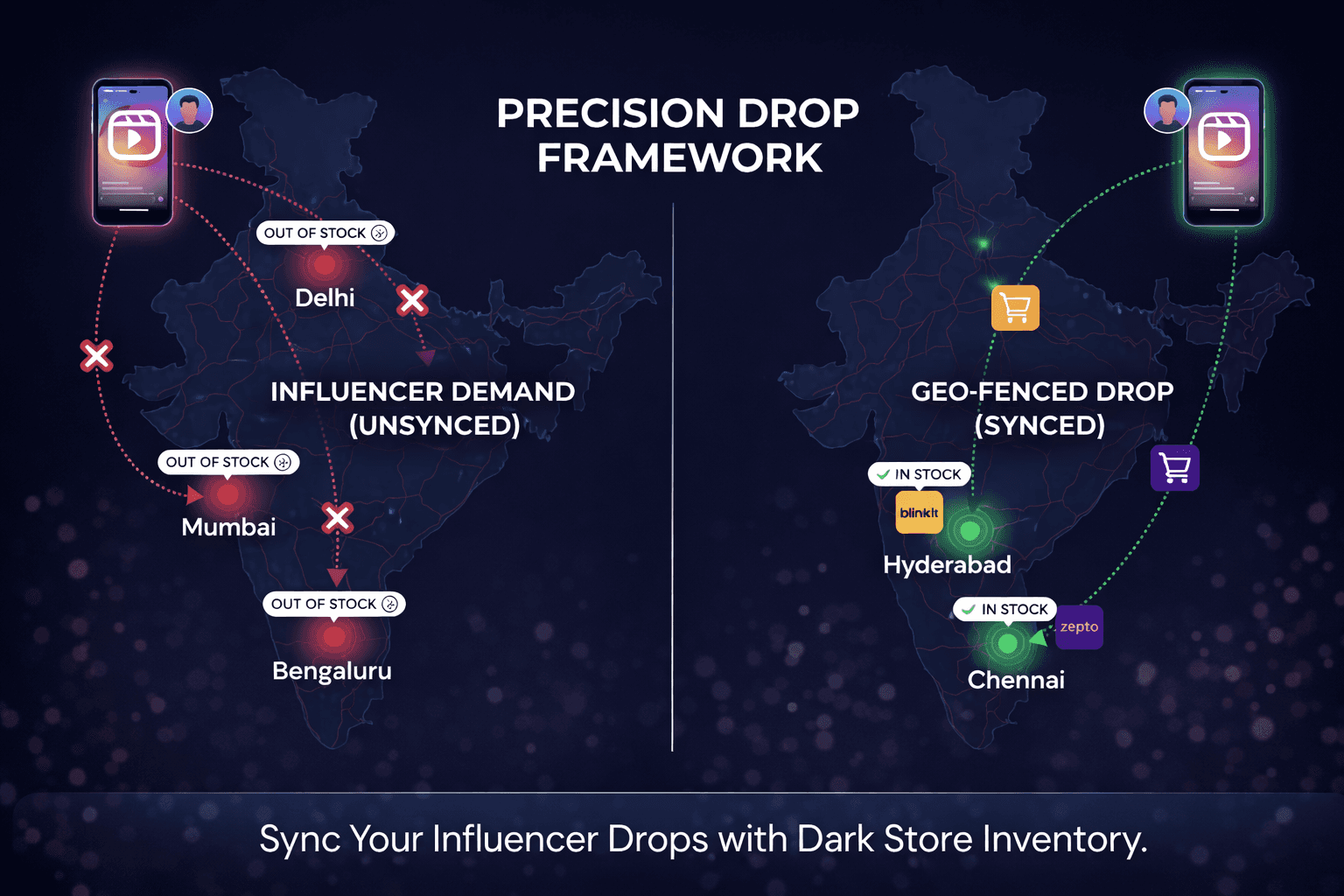

Paying for an influencer post while your dark store is understocked is like running a sale with the shutters down. The Precision Drop Framework aligns your creator drops with real-time inventory so every click has somewhere to land, and every rupee of ad spend has a chance to convert.

Why CAC Is Killing Early-Stage D2C Brands

Here's a scenario that plays out every week across Indian D2C brands. A nano influencer in South Delhi posts a viral Reel for your snack brand. Within the hour, their followers in Noida, Powai, and Koramangala open Blinkit and see three words that undo everything you paid for: "Currently unavailable."

You bought a lead. The dark store killed the conversion.

This isn't bad luck. It's a structural problem. India's quick commerce market has exploded from $1 billion to $6–7 billion between 2022 and 2024 [1]. Blinkit operates over 1,300 dark stores. Zepto runs nearly 1,000 [2]. Each serves a 2–3 km radius meaning inventory is fragmented across hundreds of hyperlocal micro-warehouses, and no single influencer's audience maps neatly onto a single fulfilment zone.

Why Getting This Wrong Costs More Than a Missed Sale

An out-of-stock event during an influencer spike doesn't just lose you that order. It signals unreliability to the platform's algorithm. Blinkit and Zepto prioritise products with high fill rates and brands that repeatedly fall short risk being quietly deprioritised in search rankings, making organic discovery harder and paid visibility more expensive.

The cost of that visibility isn't small. Blinkit charges a mandatory listing fee of ₹25,000 per SKU per state, with minimum monthly marketing spend between ₹2–3 lakh, while Zepto bundles influencer marketing, ad slots, and onboarding starting at ₹5–6 lakh [3]. Paying those rates while your dark store shelves are empty is one of the most avoidable errors in D2C marketing today.

Q-commerce rewards predictability more than novelty and that principle applies directly to how you coordinate influencer campaigns [4].

The Precision Drop Framework: Three Moves That Fix It

Move 1 - Geo-Fenced Casting

Stop selecting influencers based on national reach. Before briefing anyone, pull a city-level fill rate report from your Blinkit or Zepto seller dashboard. Any city below 85% availability is a no-go zone for creator activation. Any city with surplus stock 40% or above is your priority market.

If Zepto shows strong inventory in Bengaluru and Hyderabad, activate your nano-creator network specifically there. Demand spikes then land exactly where your shelves are full.

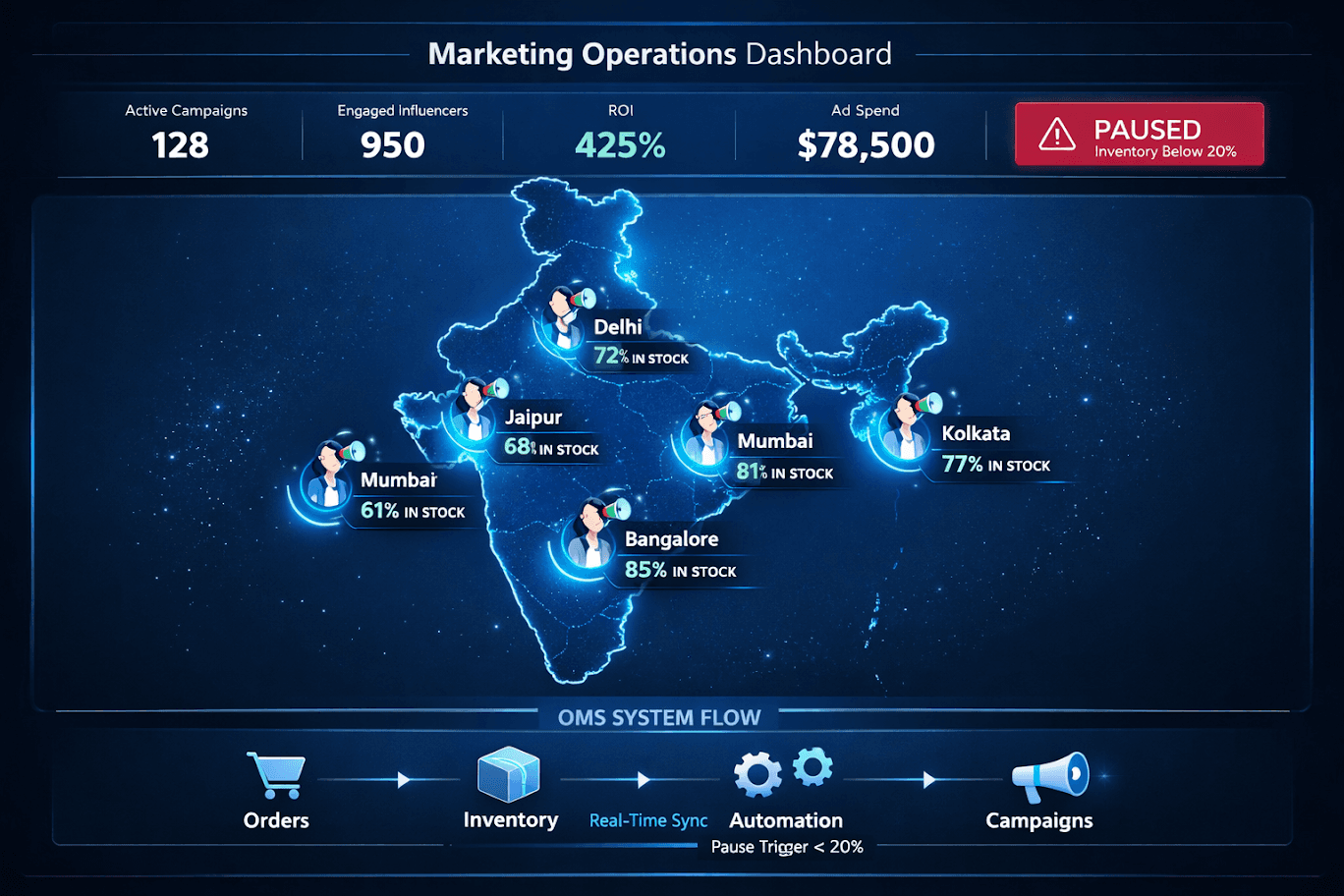

Move 2 - The OMS Pause Trigger

Integrate your Order Management System, Unicommerce or Increff both consolidate Blinkit, Zepto, and Instamart into a single dashboard with your marketing workflow. Set one hard rule: if dark store stock in a live campaign city drops below 20%, the paid boost on that creator's content pauses automatically.

This turns your OMS into your campaign's circuit breaker. No manual monitoring. No wasted spend on clicks that can't convert.

Move 3 - The Dynamic Stock CTA

Replace static "Buy on Blinkit" links with location-aware landing pages that check availability before surfacing the link. If the user's nearest dark store is out of stock, the page redirects to your D2C website or captures a "Notify me when back in stock" email instead of delivering a dead end.

Zero lost leads. Zero dead clicks.

The One Metric to Watch Before Your Next Drop

Pull city-level fill rate data from your OMS every week not just before campaign launches. The brands that consistently win on quick commerce aren't the ones with the biggest influencer budgets. No listing is permanent founders who missed replenishments and let inventory go inconsistent found their momentum tanked fast [4].

Marketing and operations talking to each other, once a week, before any creator goes live that coordination is the actual competitive advantage.

Sources

EcomDigest - Quick Commerce D2C Brands India: 7 Critical Cost Traps (Oct 2025): ecomdigest.in

Business Standard - Blinkit, Zepto hike commissions to boost revenue (Mar 2025): business-standard.com

Storyboard18 - Quick-commerce's ad fee toll: Are Zepto, Blinkit, Instamart squeezing out small D2C brands? (Jul 2025): storyboard18.com

eChai Ventures - How Top D2C Brands Win on Blinkit & Zepto — Rohit Kaul's Q-Commerce Field Notes (2025): echai.ventures

Unicommerce - How to Scale Brands on Blinkit, Zepto and Instamart (Dec 2025): unicommerce.com