When Does a Viral Trend Die? How to Protect Your Festive Season Budget Using the Trend Lifecycle Radar

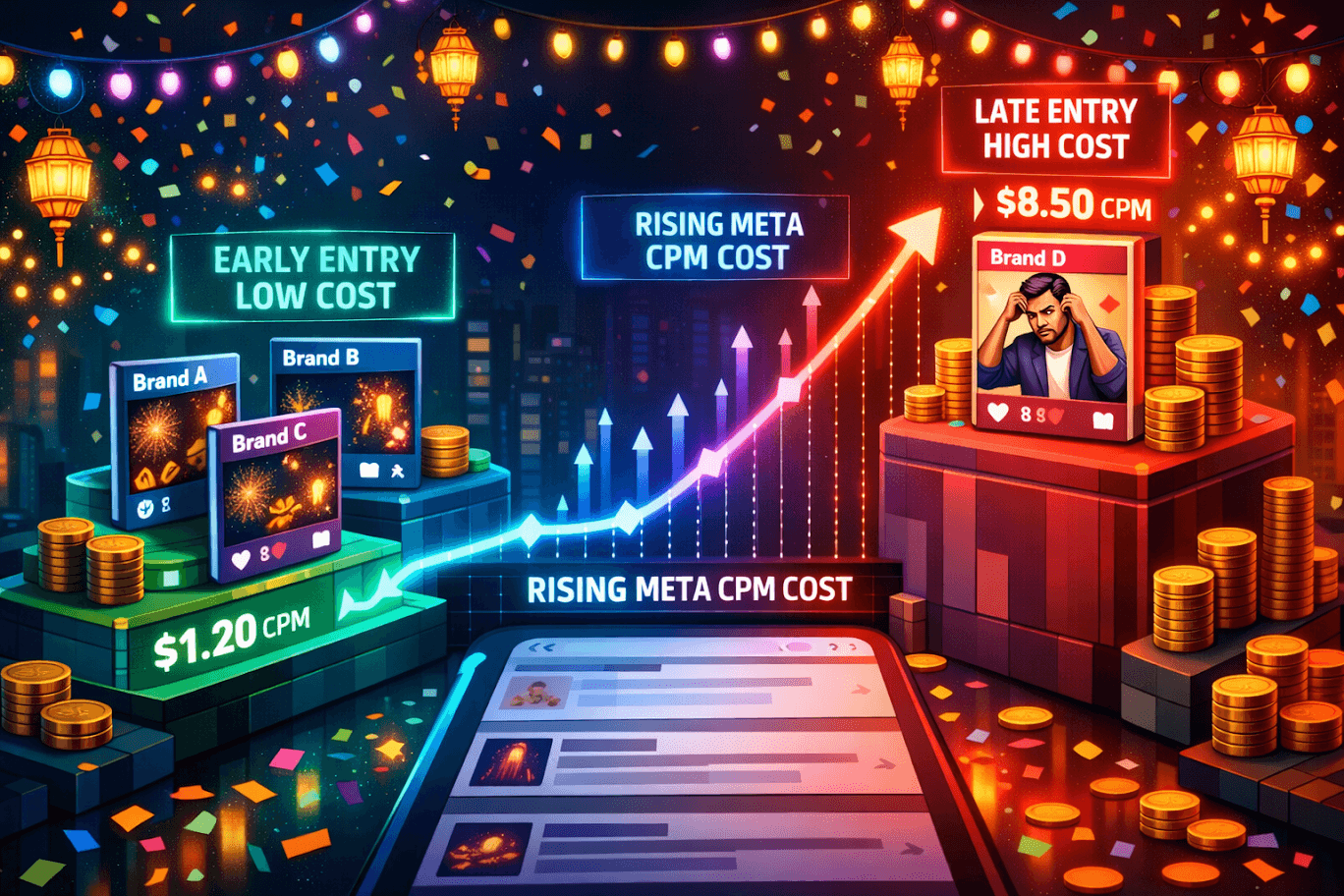

Indian brands that join viral trends late pay up to 60% more in Meta CPMs during the festive season for a hook the audience is already scrolling past. The 4-Stage Trend Lifecycle Radar tells you when to enter, when to scale, and when to quietly exit before your Diwali budget disappears into the meme graveyard.

Why Festive Season Ad Costs Are Punishing Late Movers

Every year, the pattern repeats. Brands scramble to brief, get legal sign-off, produce creative, and launch only to find themselves fighting over the same exhausted ad inventory at the worst possible time.

In India, the festive season Navratri through Diwali is the single most competitive advertising window of the year. Short-form video formats like Reels and YouTube Shorts command 20–25% higher fees than static posts during the festive rush. And Meta CPMs rise anywhere from 20% to 80% or more during this period as brands flood the platform with budgets. The brands paying the highest price aren't just victims of competition they're victims of timing. They arrived at the party after the DJ had already left.

Why Joining a Trend Late Destroys More Than Budget

Late trend entry doesn't just drain money, it signals something worse: that your brand is a follower.

When a Tier 1 bank or a legacy FMCG giant starts using the same audio that indie D2C creators pioneered three weeks ago, the cultural moment is over. Indian consumers during the festive season increasingly reward brands that demonstrate authenticity and emotional connection, the opposite of what a recycled, over-used hook communicates. Being late doesn't just cost you money. It costs you credibility with exactly the audience you're trying to win.

The Signal Most Indian Brands Miss: Nano Influencers and Niche Trust

The earliest sign that a trend is rising before it hits mainstream Reels, lives in the content of nano influencers (1,000–10,000 followers) in specific niches.

There is a massive shift happening toward micro-influencers, and this trend works especially well in India, where regional celebrations and languages play a major role. When a cluster of these creators - budget skincare, regional fashion, home décor, starts using the same audio or format, that's Stage 1. That's your entry window. CPMs are low. Competition is thin. ROI potential is highest.

The 4-Stage Trend Lifecycle Radar: Where Is Your Hook Right Now?

Stage 1 - Innovation (The Niche Phase): Nano creators in specific communities are experimenting with the hook. Allocate 10% of your experimental budget. Get in early.

Stage 2 - Early Adoption (The Sweet Spot): The hook reaches Instagram Explore and YouTube Shorts' recommended feed. Regional and mid-tier influencers pick it up. This is your moment, move 70% of production resources here. The trend still carries social currency.

Stage 3 - Saturation (The Danger Zone): A major bank, a legacy airline, or a government tourism board posts the hook. If you haven't entered yet, don't. If you're already live, watch your frequency metric. Once audiences see the same creative 4+ times, conversion likelihood drops sharply and CPMs climb further.

Stage 4 - Decline (The Meme Graveyard): Comments read "yaar yeh trend ab purana ho gaya." Parody accounts have made it. Kill the spend. Move the remaining festive budget to evergreen brand storytelling, the kind of emotional, occasion-led content that Cadbury and Asian Paints have mastered for Diwali year after year.

The 3 Death Signals to Watch Before Your Budget Burns

The CTR Decay Signal: When your CTR drops 15–20% week-over-week despite consistent spend, the hook is dying, not your targeting. Act within the week.

The Sentiment Pivot Signal: Indian audiences are direct. When comments shift from "yaar sach mein 😭" to "yeh trend ab bore kar raha hai", your dashboard will confirm it two weeks later. The comment section is faster.

The Big Brand Arrival Signal: When legacy brands begin entering a trend that was pioneered by independent creators, it reliably marks the peak of the saturation phase. Once a PSU or a heritage FMCG brand posts the audio, the cool factor is officially over.

How to Measure Before You Spend This Festive Season

Run a small pilot in September, before Navratri inventory tightens. Assign unique promo codes per creator, track UTM links through Google Analytics 4, and monitor weekly CTR movement by individual ad creative, not just campaign level.

The brands that protect their festive budgets aren't the fastest. They're the ones who know, with data, exactly when to stop.

Sources

Exchange4media - Diwali Campaigns and Festive Season Trends (2025): exchange4media.com

Eyeful Media - What to Expect From Meta Ad Campaigns This Holiday Season (Oct 2025): eyefulmedia.com

afaqs! - Festive Marketing in India: Changing Trends and Consumer Behaviour (Oct 2024): afaqs.com

afaqs! - Festive Trends Shaping D2C Digital Marketing in 2024 (Oct 2024): afaqs.com

SuperAds.ai - Facebook Ads CPM Benchmarks in India (2025): superads.ai

AdAmigo.ai - Meta Ads CPM and CPC Benchmarks by Country in 2026: adamigo.ai